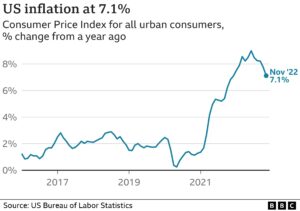

The rapid rise in consumer prices is slowing in the US, as the costs of energy, used cars, medical care and airfare fall.

US inflation was 7.1% over the 12 months to the end of November, dropping from 7.7% in October, figures from the US Labour department show.

That was the slowest pace in nearly a year and better than analysts expected.

But though the overall picture is improving, the cost of some items such as housing continues to climb.

The US central bank has raised interest rates at the fastest pace in decades this year, in an effort to get the inflation problem under control.

Earlier this month, Federal Reserve chairman Jerome Powell said that the bank would start to move less aggressively to see how the moves are playing out in the economy.

By boosting borrowing costs, the Federal Reserve is expecting to dampen demand for expensive items such as homes and cars, helping to slow the economy and ease the pressures pushing up prices.

New York comedian Davis Wesson said he has long been familiar with steep housing costs, but has found the past year particularly hard.

The rent on his girlfriend’s one bedroom apartment jumped from $2,100 a month to nearly $3,000, forcing the couple to find a cheaper place. He said even if inflation starts to cool, he will be paying higher rates on the credit card debt he accumulated during the pandemic, when he lost his job.

“It used to be only housing prices – now it’s food, it’s technology,” the 28-year-old said. “It’s so insane… a burrito is like $14 now.”

“It seems like everything is more expensive,” he added. “I think it’s only going to get worse.”

Seema Shah, chief global strategist at Principal Asset Management, said the Federal Reserve still has work to do to get inflation back to its 2% target, but the slowing inflation rate would raise hopes that it “may actually be tamed within the next 12 months”.

The Fed has been helped in its inflation flight by the resolution of many of the supply chain issues that emerged during the pandemic, as well as a sharp decline in the cost of motor fuel.

On average, a gallon of gasoline in the US now costs less than it did a year ago, motoring association AAA said last week. That is thanks in part to a drop in oil prices fuelled by investor expectations of reduced demand in the months ahead.

“While inflation is moving to a better place, it is not yet in a good place. The month-over-month changes show inflation pressures are cooling. But compared to a year earlier, prices broadly remain historically high,” said Mark Hamrick, senior economic analyst for Bankrate.com.

“Consumers rejoice that the price of gasoline has dropped sharply. But rising prices for other necessities, most notably food and shelter, remain elevated and continue to strain household budgets.”

Grocery prices have jumped 12% over the last 12 months, while housing costs are up 7.1%.

If food and energy prices, which tend to swing frequently are not included, housing drove nearly half the increase in inflation over the past year, the Labor Department said.

US shares jumped on the better-than-expected news, while the dollar fell against a basket of currencies, reflecting investor bets that the interest rate increases that have pushed it higher will slow.